“Well, I just finished filling out my income tax. I finally got around to it. I wasn’t in any hurry since I won’t get anything back.”

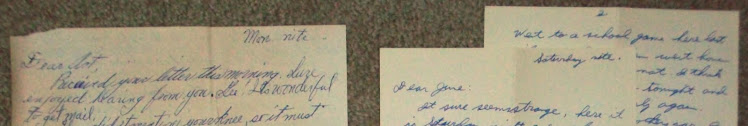

Art Price

Letter to June Anderson, March 9, 1950

Income tax was just as much a routine part of life in 1950 as it is today. So what was Art paying in taxes? With the 1950 median family income at $3,300, I think it’s safe to assume that Art’s annual earnings for working full-time at Roulston’s grocery store were less than $2,000, putting him in 1950’s lowest tax bracket. Paying a marginal tax rate of 20%, he would have contributed $200 in taxes for every $1,000 earned (without figuring in any deductions).

In 1950, the average family income of $3,300 would have been taxed at a 22% marginal tax rate. Tax rates escalated upward with income, topping out at 91% for individuals or families earning $200,000 or more. Many deductions were allowed, so it can be assumed that most high earners significantly reduced their tax burden from that 91% rate.

To compare this with taxes in 2011, the lowest marginal tax rate today is 10% – this means, a person earning less than $17,000 per year contributes $100 in tax for every $1,000 earned (half the 1950 rate). Then the tax rate increases with income, topping out at 35% for people earning $379,150 or more. Many deductions are still allowed that significantly reduce the amount paid into the system by both low and high earners.

In other words, income taxes are much lower now than in 1950 for both low and high earners.

Information for this entry was drawn from the document “Federal Individual Income Tax Rates History” on the Tax Foundation website.

(For Monday – a bad day at the races.)

© 2011 Lee Price

No comments:

Post a Comment